Germany Automotive Adhesives & Sealants Market to Reach $1,156.8Mn by 2023

Germany Automotive Adhesives and Sealants Market Overview

The Germany automotive adhesives and sealants market valued $891.8 million in 2017 and is projected to witness a CAGR of 4.5% during 2018–2023. Growing domestic and international market for German automobiles, including passenger cars and commercial vehicles is expected to drive the Germany automotive adhesives and sealants market.

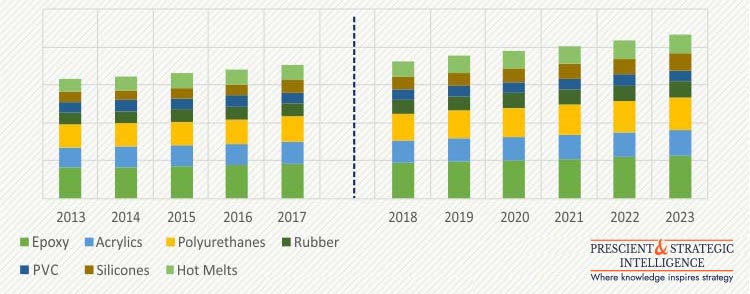

GERMANY AUTOMOTIVE ADHESIVES AND SEALANTS MARKET, BY TYPE, KILO TONS (2013–2023)

Based on the type, the Germany automotive adhesives and sealants market has been categorized intoepoxy, acrylics, polyurethanes, rubber, polyvinylchloride, silicones, and hot melts. Of these, epoxy held the largest share in the market, accounting for more than 25.0% in 2017. The dominant share of the category can be attributed its increased demand due to its highly rigid bonding capabilities, which strengthens structural integrity of the vehicle.

Based on application, the Germany automotive adhesives and sealants market is categorized into body in white (BIW), under-the-hood (UTH) and power train, paint shop, and assembly. In 2017, Assembly held the largest share in the Germany automotive adhesives and sealants market, accounting for more than 40.0% value share, driven by extensive consumption of adhesives and sealants in assembling automotive components during this stage.

Germany Automotive Adhesives and Sealants Market Dynamics

Globally, Germany is the leading country in terms of automotive production and sales. As of 2017, the country accounted for around 30.0% of all passenger cars manufactured within the European region. Major global automotive manufacturers, such as Audi AG and Daimler AG (manufacturer of Mercedes-Benz automobiles), develop vehicles using German technology. Due to the presence of sophisticated automotive technology, the country has the largest concentration of OEMs of automobiles in Europe, which generates significant demand for adhesives and sealants, thereby, driving the Germany automotive adhesives and sealants market.

Trends

In Germany, the regulatory norms pertaining to the usage of conventional adhesives and sealant are aiming to substitute the usage of these products with eco-friendly solutions. As a result, there is a shifting trend towards the usage of eco-friendly adhesives and sealants that have limited quantity of volatile organic compounds and exhibit high initial adhesion properties. Products such as water-based acrylic adhesives serve as an excellent eco-friendly alternative to solvent-based adhesives. They are increasingly being used in the manufacturing of interior trim parts and instrument panels dashboards of automotive vehicles. Such developments are transforming the Germany automotive adhesives and sealants market.

Drivers

In Germany automotive adhesives and sealants markets, epoxy-based adhesives and sealants are witnessing rapid surge in consumption for the production of various automotive components. This is mainly attributed to its strong bonding capability and higher resistance against moisture. Additionally, they offer higher durability, flexibility, and good impact resistance. Epoxy based adhesives and sealants are used during the production of signal lights, headlights, and during the bonding of bumpers in the vehicles. Germany, being one of the largest producer and exporters of automobiles, will continue to witness rise in usage of epoxy adhesives during the forecast period.

Restraints

A major restraint faced by the producers in Germany automotive adhesives and sealants market is the fluctuating raw material prices. The price of the raw materials used in adhesives and sealant are highly volatile in nature. Due to this, producers need to keep an adequate watch on the fluctuating raw material costs, as they relate to the price expectations of the customers. At the same time, they need to minimise any negative impact on their profit margins due to volatility in raw material prices. Hence, it becomes difficult for producers to maintain a balance between the cost of production and selling price, which is serving as a major restraint in the automotive adhesives and sealants market.

Germany Automotive Adhesives and Sealants Market Competitive Landscape

Some of the major players operating in the Germany automotive adhesives and sealants market are Henkel AG & Co. KGaA, DowDuPont Inc., Sika AG, 3M Company, H.B. Fuller Company, and tesa SE.

Kalyan Banga226 Posts

I am Kalyan Banga, a Post Graduate in Business Analytics from Indian Institute of Management (IIM) Calcutta, a premier management institute, ranked best B-School in Asia in FT Masters management global rankings. I have spent 14 years in field of Research & Analytics.

0 Comments